Why Fall and Winter are Prime Time for Savvy Homebuyers

Forget the scorching sun and overheated bidding wars. As summer fades and leaves begin to swirl, a hidden gem emerges in the housing market: the fall and winter off-season. For strategic buyers seeking optimal deals and a calmer negotiation landscape, these cooler months offer a treasure trove of advantages. So, ditch the lawn chairs and trade poolside piña coladas for a steaming mug of cocoa – the off-season market awaits with open arms (and potentially lower price tags). Competition Takes a Siesta: Imagine a bustling marketplace, buyers jostling for every available property like shoppers on Black Friday. That's the spring and summer housing scene. But come fall and winter, the market cools down, with fewer buyers searching for their dream homes. This translates to significantly less pressure, giving you a higher chance of your offer being accepted without the stress of a bidding frenzy. Think of it as having your pick of the litter without the elbows-out competition. Motivated Sellers, Sweet Incentives: As the holidays approach, unmoved sellers start feeling the pressure to close the deal before the year ends. This eagerness translates to significant flexibility on their part. Imagine securing closing cost credits, upgraded appliances, or even that dreamy backyard deck you've been eyeing, simply because you acted before the holiday rush. Remember, a motivated seller is often a negotiable seller, and winter can be your bargaining chip. Quality Over Quantity: While the overall inventory might shrink during the off-season, don't mistake it for a lack of options. The remaining listings tend to be the "diamonds in the rough," the houses that stood out even during the peak season. Think charming fixer-uppers with hidden potential or modern marvels with stunning winter views. These are the properties that offer both value and uniqueness, waiting to be discovered by discerning buyers like you. Think Tank Time, Not Time Crunch: Picture this: you're at an open house, surrounded by a swarm of eager buyers, barely getting a chance to peek into the closets. That's the reality of the peak season. In contrast, fall and winter offer a serene pace, allowing you to meticulously analyze each property without feeling the pressure of a ticking clock. Conduct thorough inspections, compare different neighborhoods, and negotiate terms with a clear head and a focused mind. Remember, a well-informed decision is a powerful tool in any negotiation. Beyond the Deal: Strategic Advantage: Buying in the off-season isn't just about saving money; it's about gaining control. Enjoy the satisfaction of navigating the market on your own terms, escaping the summer frenzy, and securing a home before the next spring rush. Plus, you'll have ample time to settle in before the busy holiday season, making decorating and hosting that much more enjoyable. Think of it as a strategic move that grants you both financial and logistical advantages. Bonus Tip: Worried about missing out on the house's true potential due to winter weather? Think again! Sellers understand the power of winter charm. Expect beautifully staged interiors showcasing a warm and inviting atmosphere, complete with crackling fireplaces and festive touches. Imagine stepping into a cozy living room bathed in the soft glow of Christmas lights – winter can be the perfect backdrop for showcasing a home's potential. So, if you're a buyer who values smart deals, thorough analysis, and a calm negotiating environment, don't wait for the spring thaw. Embrace the quiet charm of the fall and winter housing market. Your dream home, secured on your terms, awaits in the crisp autumn air or sparkling winter wonderland. Remember, sometimes, the best deals come wrapped in a cozy sweater and a steaming cup of cocoa.

Read More

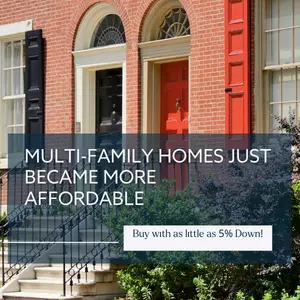

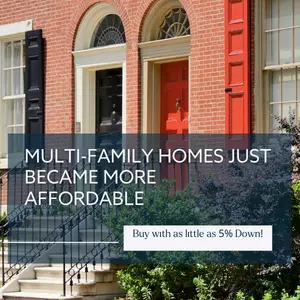

Multi-Family Homes Just Became More Affordable!

Fannie Mae's game-changing program lets you buy a 2-, 3-, or 4-unit home and live in one unit while renting out the others – with just 5% down! This means: Lower upfront costs: Start building your real estate portfolio with significantly less cash. Offset your mortgage: Enjoy the benefits of homeownership while generating rental income. No self-sufficiency test: Qualify for a 3-4 unit property more easily than before. Previously, 15-25% down was required, making multifamily ownership inaccessible to many. Now, the door is open! It could mean big changes for multifamily home buyers. Fannie Mae is known for offering down payments as little as 3-5%. Before the change, that only applied to 1-unit properties. A two-unit home (duplex) required 15% down and 3-4 unit homes required 25% down. Both will be reduced to 5%. That previous down payment levels hindered many would-be owner-landlords. Especially since these properties are much more expensive than a typical single-family home. A $500,000 triplex required a $125,000 down payment. But effective November 18, 2023, only 5% down will be required, or $25,000, a difference of $100,000 in this case. Following are additional examples of reduced down payment needed. 2-Unit 3-4 Unit Example home price $400,000 $500,000 Min. down payment before 11/18/23 $60,000 (15%) $125,000 (25%) Min. down payment after 11/18/23 $20,000 (5%) $25,000 (5%) Upfront cash reduction $40,000 $100,000 The changes apply to standard purchases, no-cash-out refinances, HomeReady, and HomeStyle Renovation loans for owner-occupied transactions. Cash needed including reserves: The down payment isn’t the only upfront cash needed. You will need: Down payment (5% of purchase price) Closing costs (around 2-4% of purchase price) Reserves (6 months of the full payment) The big caveat to this new program is that Fannie Mae requires you to have six months of the full payment in reserve after paying the down payment and closing costs. You don’t need to pay this money, but you must prove you have it in an accessible account. For example, a $400,000 duplex would require $20,000 down payment and about $12,000 in closing costs upfront and $21,000 in reserve after closing (assuming a $3,500 full payment). You would need $53,000 total in savings, checking, and other accounts to qualify. This could be a large barrier for first-time buyers, but Fannie Mae has so far not repealed the six-month reserve rule. Here's what you need to do: Contact She Moves Realty: We'll help you navigate the process and find the perfect property. Get pre-approved: We'll connect you with our mortgage partners. Find your dream home: We'll help you search and negotiate the best deal. Why choose She Moves Realty? Multifamily experts: We specialize in helping clients achieve their multifamily ownership goals. Loan assistance: We'll guide you through the mortgage pre-approval process and connect you with the right lender. Seamless closing: We'll ensure a smooth and stress-free closing process. Post closing assistance: We'll walk you through getting your rental ready to go and even help you secure your new tenants. Don't wait! This program is a game-changer for anyone who wants to build their rental portfolio or set their future selfs up with passive income. Contact She Moves Realty today to start your journey!

Read More

Maximize Your Savings: The Philadelphia Homestead Exemption

As you navigate homeownership in Philadelphia, it's essential to be aware of a valuable opportunity that could significantly impact your finances—the Homestead Exemption. In this tailored guide for recent homeowners, we'll explore the Homestead Exemption, providing insights into its eligibility criteria, benefits, and the importance of taking action promptly to maximize your savings. The Homestead Exemption is a program specifically designed to benefit primary residence homeowners in Philadelphia. Its goal is to reduce the taxable portion of your property's assessed value, offering tangible financial benefits to homeowners like yourself. You can get this exemption for a property you own and live in and do not have another tax abatement. You are still eligible if you have a mortgage or are delinquent on your taxes. Upon approval of your Homestead application, you'll experience a noteworthy reduction in your property's assessed value—specifically, a substantial $80,000. For recent homeowners, this translates to an annual saving of approximately $1,119 on your Real Estate Tax bill, providing valuable financial relief as you settle into your new home. Once your application is accepted, there's no need to reapply for the exemption. Regardless of any future changes to the exemption amount, you're guaranteed property tax savings without the hassle of annual paperwork. Deadlines and Application Process: The final deadline to apply for the Homestead Exemption is December 1 of each year. Early filers should apply by September 13, to see approval reflected on their Real Estate Tax bill for the following year. Applicants approved after September 13 date will receive a second bill with an adjusted amount due. How to Apply: Online: Utilize the user-friendly Homestead Exemption application on the Philadelphia Tax Center. No need to create a username and password—simply submit your application online. If a previous owner is listed, consider calling or submitting a paper application. By Phone: Reach out to the Homestead Hotline at (215) 686-9200 to apply over the phone. By Mail: If you prefer the traditional route, print and use the Homestead Exemption application. Send your application to: City of Philadelphia Department of Revenue P.O. Box 52817 Philadelphia, PA 19115 Embarking on homeownership is a significant journey, and we're here to support you every step of the way. If you have any questions or need guidance with your Homestead Exemption application, feel free to reach out. As you settle into your primary residence, seize the opportunity to maximize your savings through the Homestead Exemption.

Read More

Categories

Recent Posts